The Essential Personal Financial Foundations Guide – Current Crisis Edition [Free Worksheets, Processes & Information]

Your valuable financial foundations crisis edition guide is here.

We are Sydney based financial advisers and we want you to be better prepared to be successful during this crisis.

You now have the information, tools and processes needed to make more informed financial decisions.

Our simple equation is:

Awareness + Accountability + Goals = Financial Plan Success

By the time you finish this you will be in a position to confidently understand where you are financially.

You should be better educated and now able to identify any gaps in your financial affairs, highlight any risks and be in a position to approach the future with more confidence.

Cash Flow/Budget:

Let me be clear, cash flow really is the most important to your overall financial success and peace of mind.

It is always a good time to know what your income vs earnings look like.

There’s no benefit to ‘sticking your head in the sand’ hoping it will be okay without measuring.

This is even more important for you in difficult times when unemployment is rising.

The clarity you get from being aware of your financial position will mean you can adapt to current circumstances in good times or bad.

It is as simple as this formula:

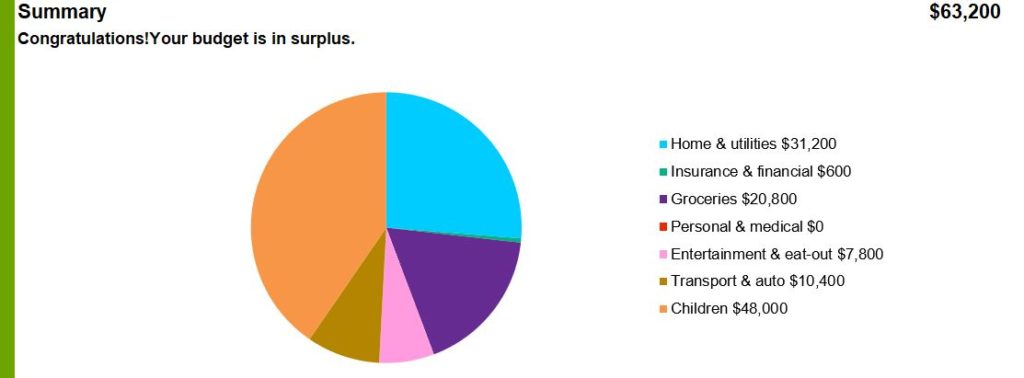

(SUM OF MONEY GOING IN) – (SUM OF MONEY GOING OUT) = BUDGET FIGURE

CLICK HERE: BUDGET PLANNER WORKSHEET

Once you know this BUDGET FIGURE you can begin to plan ahead.

GOING THROUGH THE BUDGET SHEET PROCESS:

Understand what your

- Employment Income is ($________ per month)

- Investment Income is ($________ per month)

- ‘HARD’ fixed living costs are ($________ per month)

- ‘WANTS’ variable living costs are ($________ per month)

IMPORTANT: Do you have access to 6 months cash worth of expenses assuming no income is coming in.

What has COVID-19 taught us about emergency cash flow?

COVID-19 has taught us a new meaning of ‘things coming to a complete stop’ and that we need to be prepared within reason for future living expenses assuming no income.

We have always believed that it is necessary to have 6 months worth of ‘at call cash’ at any time.

Basic cash flow habits:

- Allocate a portion of your income to hard living costs

- Allocate a portion of your income to ‘wants’ or entertainment .. things you enjoy.

- Allocate a portion of your income to ‘the future’ also known as savings/investments

- You ‘future’ fund is where you can plan ahead and start to put a plan in place around what is best for you – eg. pay down your own home debt or buy an investment property?

- Having access to 6 months worth of expenses in cash (redraw/offset) is essential.

Questions on your outcome:

- Does the budget show a positive or negative amount? If it’s negative, you need to make some changes – either earn more, or spend less.

- Please note, if your budget is negative with a plan that is okay, as long as you understand the impacts of it.

For example, 3 kids that you want to go to private school may possibly mean some negative cash flow years. - If your budget template is positive, what are you doing with that surplus to put yourself in a better position.

That will put you in one of two positions of clarity.

- There’s areas I can look at cutting down costs to improve my cash flow

- My expenses can’t really get any lower

Either way, at least you know.

Once you know this BUDGET FIGURE you can begin to plan ahead.

What your planning ahead conversations may look like:

- How many months of living expenses do we have available as cash?

- If I couldn’t work, how long could I sustain my current lifestyle?

- How quickly can I save up for a home deposit?

- How quickly can I pay down my own home debt?

- Can I afford to send my kids to a private school? If yes, how much should I put aside each year and from when?

- Can I afford another investment property?

- Can I upgrade my car?

- Should my salary sacrifice money into superannuation?

- What can I do to build my wealth?

- Can I make my affairs more tax effective?

- Can I go for a family holiday each year and still be debt free?

- How quickly can I pay down my credit card debt?

- Can I build a share portfolio?

A common trait our most successful clients have is that their cash flow tracked, with outcomes regularly measured and someone to keep them accountable.

3 ways to significantly reduce your hard expenses

The key obvious advice here is to have your fixed expenses as low as possible. That means you will be in a better position to deal with change.

Every $100 you save per month means $1,200 back in your pocket each year.

1. Review your mortgage payments

After speaking with a few mortgage brokers we have been advised there are interest rates in the low 2% mark for homeowners.

If you would like us to put you in touch with one, let us know below

2. Review your utility providers – I bet you can save here with some phone calls.

- Phone bills

- Electricity

- Gas

- Water

- Streaming Services (Eg. Spotify, Foxtel, Netflix, Stan)

3. Insurance Review – Personal Insurances and private health insurance

- Personal Insurances, are you using your Superannuation to fund the life insurance and income protection premiums where possible? (more about personal insurances below)

- Private Health Insurance – make a few phone calls to compare cover or get in touch with a provider that will compare it for you.

More budgeting resources:

If you want a solution that tracks all of data live – including property valuations, income, credit cards, expenses and more – let us know. Here is a solution we use with our clients to make it visual and easier for them.

We can give you a free account (it doesn’t have live feeds) but is a great tool for storing assets, liabilities and important documents with banking level security.

https://peakwm.com.au/confused-about-how-much-you-should-save-heres-what-experts-say-moneymag-article

https://peakwm.com.au/moneymag-crisis-budget-leaks-fix

Superannuation

What Superannuation is?

Superannuation (super) very simply is money or assets that are:

- put into a different tax environment

- that has some restrictions on how it can be used

- designed to be a forced retirement savings account

- The money that goes in will go to certain assets based on your selected option

Myth, I have no control over my super

Many people we speak to seem to think Super is a mythical being that we have no control over. Let us tell you now, that is incorrect.

It is up to you to understand your super account because if it is not at the level you expected it to be when you are about to retire, there is no one else to blame other than yourself.

Ways to contribute to super

There are two basic types of super contributions you can make:

- Concessional contributions (CC); which are made from ‘before-tax’ income and get taxed in your superfund at 15% (until $25k annual cap is reached – 30% after that point)

- Non-concessional contributions (NCC); are made from your ‘after tax’ income and don’t get taxed in your superfund.

Let us expand on our opening dot points.

Superannuation is just another tax environment.

It is extremely tax effective, but it still gets taxed and here’s how:

- 15% tax paid on pre-tax contributions and super investment earnings

- 10% tax paid for capital gains tax events inside super

This is some examples of what both types of contributions would look like to you and they would be taxed.

- Your Superannuation Guarantee Contributions (SGC) which are compulsory to be paid your employer would be taxed at 15% (CC)

- Your personal superannuation contributions that you claim as a tax deduction for in your personal tax return would be taxed at 15% (CC)

- Salary Sacrifice arrangements you have with your employer where you don’t receive your income in your personal name, it goes to your superfund and you would be taxed at 15% (CC)

- Additional money you contributed to your superfund and not claimed a tax deduction on would not be taxed in the fund (NCC)

- A government co-contribution is not taxed in your superfund (NCC)

- If applicable to you, the Low Income Super Tax Offset (LISTO) will not incur any tax within your superfund

- When you make a contribution before tax (e.g. money your employer contributes from your pay)

Your super is an entity of yours, with some restrictions.

The tax effective super environment does come with some strings attached (more like chains).

You can withdraw your super once you reach the age of 65, regardless of if you work or not.

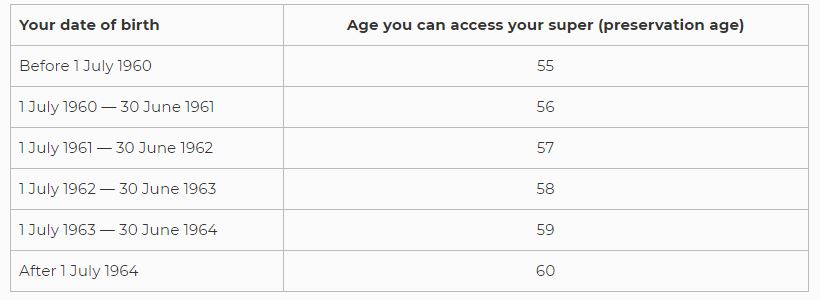

If you retire before you reach the age of 65, you can get your super when you reach your ‘preservation age’

Your ‘preservation age’ is dependent on when you were born:

If you haven’t permanently retired then you can set up a transition to retirement pension account. We are happy to explain this in more detail if you want to contact us.

In the fortunate and rare event that you have a defined benefit pension account, some of them we have come across will start paying the defined benefit amount at the age of 55.

There are some other tough circumstances in which you can access your super early:

- Incapacity – in the event you are unable to work or you need to work fewer hours because of a medical condition

- Severe financial hardship – if you can’t meet your living expenses and have been receiving Commonwealth benefits for 26 weeks.

- Compassionate ground – to pay for unpaid expenses. These could include your medical treatment, modifying your home or vehicle because of a severe disability, funeral expenses or a loan repayment basically only to prevent you losing your home.

- Terminal medical condition – if you have a terminal illness or injury.

- COVID-19 – more information below

These restrictions the government has put on us accessing super, are there to ensure it is a forced retirement savings account.

COVID-19 Coronavirus and Early access to your super

Don’t forget to check government websites.

From 20 April, some people can apply for up to $10,000 of super in 2019/2020 and another $10,000 in 2020/2021.

You can apply to access your super if you are:

- Unemployed

- Eligible to receive a JobSeeker payment, youth allowance for job seekers, parenting payment, special benefit or farm household allowance

- Been made redundant or your working hours have been reduced by 20 percent or more since 1 January 2020

- You are a Sole Trader and your business was suspended or your turnover has reduced by 20 percent or more since 1 January 2020.

If you can meet these requirements, you won’t pay any tax on your super you withdraw and it wont affect your Centrelink or Veterans’ affairs payments.

Before you withdraw. Please note, withdrawing investments in global economic crisis times like this will typically result in a financial loss. More information to come on this statement below.

Consolidation of super

Define – Consolidating Your Super: It means moving all of your superfund money to one account.

Typically, the reason for doing this is to:

- Avoid paying multiple sets of fees

- One place to see your funds

- Easier to manage

- Preferring one funds benefits or investment options over another

(RISKS) A few things you need to be aware of before you consolidate:

- Losing employer benefits if funds are changed – for example, your employer may offer a contribution match or bonus for putting more money into your account.

- Losing Insurance Cover – before you consolidate please ensure that it has no insurance cover attached to it. You should be aware that if you close the account the insurance will be lost. You should not cancel that without having other cover in place in line with your needs.

- Chasing the previous years best performing fund – don’t just swap to last years best performing fund without understanding more (see below)

- Binding nominations* – having multiple funds allows you to have different binding nominations in place (if that is appropriate for your overall estate plan)

*Legally binding, formal written direction on where your superfund is to go.

Don’t let anyone/any company fool you into moving your superfunds without checking all of the above information.

Don’t be afraid to have multiple superannuation accounts if you have a strategy behind it.

Example on where you might want to have multiple super accounts:

Your employer puts in an extra 50% of super contributions into your account each year if you use the employer super account, but they don’t have the investment options you prefer.

They also offer discounted insurance premiums that you can’t get elsewhere because of health reasons.

You could keep the employer contributions going to that account along with a sum that is greater than the minimum to retain the fund.

The remaining funds could be moved to another account that has the investment strategy you like eg. ethical investments, active management. You could roll money over from your employer super to your preferred account annually (or whenever works best according to your situation).

Investment strategy inside your superfund

You need to know that depending on what your investment strategy is inside your fund, is what kind of pain or success you would be feeling right now.

Your fund returns directly relate to what the investments are in the fund.

MYTH: You can’t control how your super is invested. It just goes from my paycheck to a company and they do what they want with it.

FACT: You are able to have a degree of control over your super even without a self managed superfund.

DON’T BE SHY TO CALL YOU SUPERFUND AND ASK HOW IT IS INVESTED

Exploring asset types – Defensive assets vs Growth assets

There are 2 asset types when we talk about investing:

- Defensive assets: include investments such as cash and fixed interest. They tend to carry lower risk levels. They are generally expected to provide investment returns in the form of income.

- Growth assets: include investments like property, shares, alternative investments. They tend to carry higher levels of risk, but they have the potential to deliver higher returns over longer investment time frames. They are generally expected to provide investment returns in the form of income and capital appreciation.

There is a time and a place for all investment types. You need to understand that they have different characteristics and will perform differently at various times. Please be aware that having international assets (any class) will add a level of risk due to the fluctuations in currency.

Perceived ‘Investment RISK’ when investing refers to the allocation of growth assets in your portfolio.

- It’s important to think about how much risk you are comfortable but also tying it into your personal goals

- Higher risk will usually achieve higher returns over the long term

- Lower risk will usually achieve lower returns over the long term

‘When you need to access funds’ – this statement defines a specific time eg. in 6 months – this should have a level of impact on your investment choices and overall risk profile.

Risk Profile Questionnaire – Worksheet

Please take 5 – 10 minutes to complete this risk profiling tool that will help give you a base level risk profile.

To download the worksheet click here or the red button below:

The risk profiling tool gives you a simple understanding of what your basic asset allocation should look like. Higher risk profile score would mean your portfolio should have a higher ‘growth asset’ allocation.

General theory is that the more risky an asset class is the longer time frame you would want to leave for it. Cash, you can use whenever you like as the asset remains constant in value, where a property might be worth less next year depending on market factors and will take time to sell.

For this reason, we would allocate a longer investment time period for growth assets than defensive assets. Superannuation has a forced long term nature to it for most (unless retiring soon).

Explained: 4 main asset classes – Cash, Fixed Interest, Property, Shares

Keeping it simple, the 4 MAIN asset classes are:

- Cash (defensive)

- Considered lowest risk asset, for the most part when you put $10 in your cash bank account when you check it the next day it will still be there

- Current interest rates are close to 0% around the world, meaning no REAL investment return when factoring inflation in.

- Benefits of having cash are – it won’t be impacted by crazy market swings. The balance will remain constant.

- Holding cash also means that you can buy other assets.

- Fixed Interest (defensive)

- Typically Bonds (corporate and government), capital notes, debentures, income securities

- Considered fairly low risk, but still carries risk. The principal investment may not be returned if the company fails or the value of bond/income investment may go down based on other factors like the market offering a better rate.

- It offers investors a regular income for a certain period of time (term) with the expectation that the initial investment will be repaid at the end of the term (maturity)

- Benefits of having fixed interest are regular income returns at a set interest rate. Making it easier to plan for a specific outcome and period.

- Property (growth)

- In super or managed investments this typically refers to industrial, retail or commercial real estate. It can be a listed or unlisted property fund/trust.

- Considered higher risk than all defensive assets as asset prices can fluctuate over time. The risk is that at the time you want to sell, the fund can not redeem the assets for cash (properties take time to be sold) or the value could be lower than you would hope.

- The returns come from increases or decreases in the asset value along with rental income.

- Benefits of owning property is that it has the potential to grow in value over the longer term.

- Shares/securities (growth)

- Stocks, managed funds, shares, listed companies, unlisted companies, exchange traded funds and more. You effectively take ownership of a company or a trust that has underlying assets.

- Example: you buy Commonwealth Bank Shares. You now own a percentage of that company. You get access to it’s growth, losses and dividends.

- Returns come from increases or decreases in the company/asset value and also come in the form of dividends (profits) which are paid to shareholders.

- Risk that prices of companies will fluctuate over time. Shares are considered the most volatile asset, this is because it is valued more than every second.

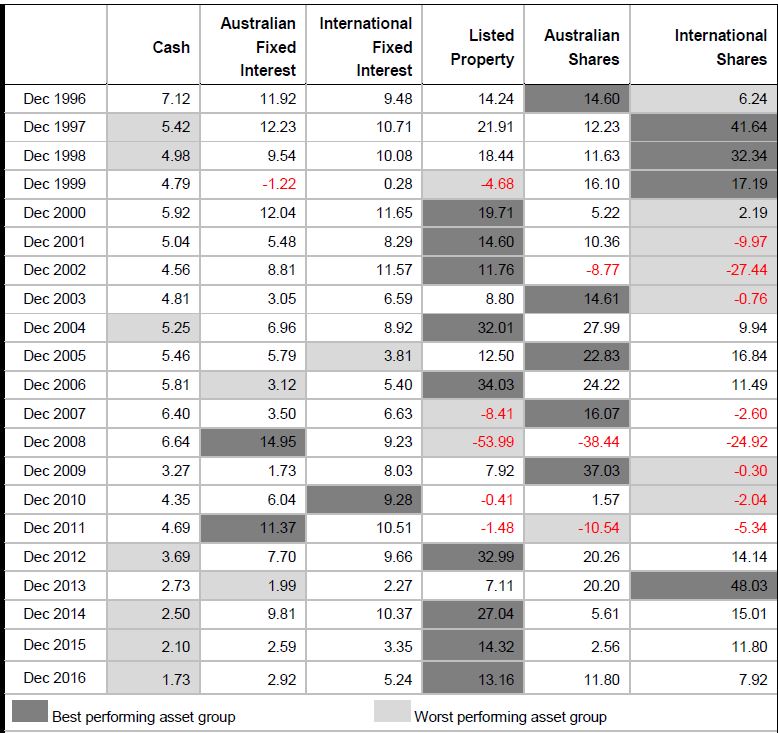

Market Returns of different asset classes – Including graphs

Your market returns come from what the underlying assets of the fund was.

Relating this back to the current crisis. It really depends on what your super was invested in to dictate what level of pain you would have felt because of this market drop.

If your superfund was invested purely into cash, you would have seen no portfolio reduction. However, you will also not see any gain the market may have over the coming years.

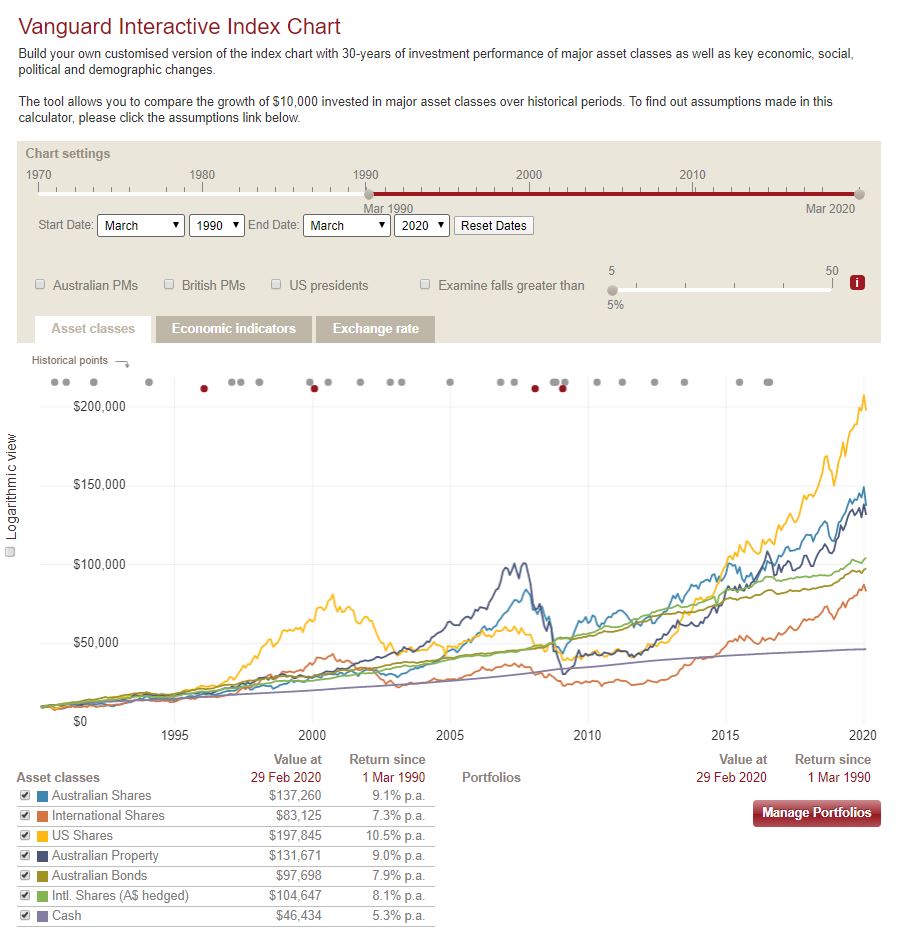

Here’s another chart that compares different asset classes over 30 years. Initial investment in each would be $10,000.

Generic Investment Options Almost All Funds Have These

When you look at your average superannuation provider balance they may have a few option. They will typically be PRE-MIXED investment options.

- Growth (might be 70%-90% growth assets, the remainder in defensive)

- Balanced (might be about 5%-70% growth style assets)

- Conservative (approx 30% growth assets)

- Cash (100% defensive assets)

You might also see a MySuper style default option where it adjusts your risk profile/asset allocation to growth assets based on your age and will put your money in a diversified mix of investments.

For example, the younger you are the higher allocation to growth assets. As you near retirement, the defensive portion of the portfolio will get larger with a sell down of growth assets.

Important Case Study Image: Cost of Selling Growth Assets In A Crisis

This graph below is very important – it is a hard lesson to learn if you get caught making this mistake.

Look closely at the graph:

- Staying invested over the time period yielded the best results

- Existing the market and reinvesting a year later was next best

- Exiting the market and staying in cash was detrimental

Fees

With anything, it makes sense to keep fees to an absolute minimum. Superannuation is no different.

It is also important to note that when deciding what is best for you, fees can’t be the only thing you look at. Assume super is also like any other product you are used to, quality and price need to have a balance.

It is important to note that there are various fees in a superannuation account, some seem to split up their fees to make it seem less expensive. Here are some of the fees to look out for.

- Administration fees

- Investment fees

- Performance fees for the investments

- Advice fees

- Switching costs

- Buy/Sell Spread

- Exit fees

A good indicator of cost is the funds ICR (Indirect Cost Ratio) which is the most conclusive fee as it factors in performance fees.

CLICK HERE or the button below to download the spreadsheet where you can add this information in.

Different funds are structured in different ways, they can incur different tax obligations at different times, they can have different investment options and more.

Find what you want in a fund, with the options that you want and then go price searching.

Ensure that your superfund delivers the strategy first, then focus on the product (company etc) after when you can compare apples to apples.

Who your super will go to? Binding Nominations / Non-Binding Nominations

Keeping it simple with where you superannuation goes if you were to pass away. It is important to note that your super is not covered by your WILL.

This is important to check regularly as you want to ensure it goes to the right person.

Trivia: How many times do you think we have reviewed a divorced person’s superfund and found they still have their ex-partner as the person to legally receive all the funds from the superfund. The answer is TOO MANY TIMES.

Options with how to direct your superfund where to send your account balance (and any insurances) in the event you were to pass away:

Binding Nomination: Legally binding, formal written direction on where your superfund is to go.

You provide a formal written letter (usually each company will have their own form) that needs to be signed and witnessed by another person that is not the one receiving the funds.

They can expire, be sure to find out when.

Non-binding Nomination: This is not legally binding. You nominate who you prefer it to go to but the superfund trustee will consider who you have chosen.

Insurance

This is all about what life insurance and income protection is and how it is used to protect you and your family.

We’ll be covering how you can use your superfund to pay for all (or most) of your personal insurance premiums.

What is Personal Insurance (Life Insurance)?

MoneySmart.gov.au has written Personal Insurance – Life Insurance can help protect you and your loved ones financially if something unexpected happens.

Main Types Of Personal Insurance Cover Policies

- Life Cover – pays a lump sum when you die

- Total and Permanent Disability Cover (TPD) – pays a lump sum to help you with rehabilitation and living costs if you are unable to work again.

- Trauma Insurance/Critical Illness Cover – covers you if you’re diagnosed with a major traumatic illness. E.g. cancer, heart attack or stroke.

- Income Protection cover – pays some of your income if you can’t work due to illness or injury

- Buy/Sell or Key Man Personal Insurance – Ensure a smooth transition of business ownership in the above listed events (and possibly more)

In simple terms, it is a type of cover that provides financial security to you and your family in certain events.

How can personal insurance protect me and my family?

Your personal insurance should tie in as the ‘risk reduction’ component of your overall financial plan.

Think about it like this… you probably have a car insurance policy just in case something goes wrong.

Exact same concept, except, you are far more valuable than your car.

You can use the different policies available to give you and your family a desired outcome in certain unexpected scenarios.

Here are some things to consider that you can provide as an outcome with a sum insured amount for each main policy.

If you know what you want, it makes it easier to provide a dollar figure that means something to you.

Scenarios you can cover and how to calculate amounts

“In the even you were to pass away”

- Funeral expenses

- Clearing debts (eg. own home paid off for the family, clearing off investment debt means an income stream for your family)

- Income (eg. cover $100k per annum for 10 years so your family doesn’t have to change living standards)

- Expenses (eg. private schooling fees are $30k per child for 6 years

“In the event you were totally and permanently disabled” (you couldn’t work again)

- All of the above considerations

- Medical expenses (eg. one off medical expense cost covered)

- Carer cost (eg. an amount left to pay for a carer or for a partner/family member to care for you so it is not a financial burden.)

- The gap not covered by Income Protection (eg. if you needed your full income to maintain lifestyle in this event)

“In the event you couldn’t work for an extended period of time due to injury or illness”

- Have you income replaced (typical maximum amount is 75% plus Super contributions)

- Have this cover starts paying from a certain amount of time you are unable to work “waiting period” (eg 14 days, 30 days, 6 months, 1 year) all the way up to the amount of time you want it to keep paying your income for “benefit period” (eg. 1 year, 2 years, 5 years, up to the age of 70)

- Simple example of what this would look like for protecting a $120k income without super contributions would be $120k x 75% = $90k per annum. It is paid on a monthly basis so you would still have $7,500 per month being paid into your bank account to meet living expenses and debts.

“In the event you suffered a serious or critical medical trauma event”

- Medical costs (eg. to see the best doctors and cover treatment)

- Partner/Family subsidy – during these times loved ones would typically take time off work to care for you which is not covered (eg. partner earns $100,000 per year. Taking 6 months off to be with you, could add in $50,000 onto the policy)

- Child trauma (eg. lump sum if your child has a trauma event)

What premiums can be paid for by your superannuation fund?

Keeping it simple, we can structure the following policies to be paid for by your superfund

- Life (death) insurance

- Total and Permanent Disability

- Income Protection

The added benefit to having your superfund pay for these premiums is it will collect the tax deductions associated with these premiums.

Trauma/Critical illness cover needs to be paid for personally. This is because if you have a traumatic event that does not meet a ‘condition of release from superannuation’ then the essential funds you need would be trapped inside superannuation unless you meet one of those conditions.

How to have your superannuation fund pay for the premiums?

Where possible, you can have your policy set up with superannuation fund ownership and have the premiums paid for with your superfund money.

If you have an existing retail insurance fund, some providers will allow you to change the ownership of the policy. Please be careful that there are no risks to you by doing this eg. extending a waiting period.

Did you know these 3 things about personal insurance?

- You can pay for the premiums of Life Cover, TPD Cover and Income Protection cover through your Superannuation fund.

Without realising you might already have these provided to you automatically inside your superannuation fund. - Personal Insurance (policies) are a contract. Normally between the Life Insurance company, the person insured and the person/entity paying the premiums. If you have taken out a retail insurance product and have had to go through ‘medical underwriting’ companies typically can’t change your contract.

- Not all personal insurance policies are equal. Different products and policies have different contract terms and will without doubt have different costs. Age, occupation and amount insured will all have a major impact on the premium price.

Make sure you know what your policy covers you for and when you are eligible to claim on it.

Impact of Coronavirus COVID-19 on Personal Insurance?

We have had several enquiries over the past month from new (and existing) clients wanting to confirm that their personal insurance cover will provide them with the same policy benefits in the event they are impacted by the coronavirus COVID-19.

Great news from the insurance providers has followed.

“My travel insurance won’t cover me for anything coronavirus pandemic related, does that mean my personal insurance won’t either?”

Simply put, many high quality insurers have stated as long as you follow Government travel advice your personal insurance policies will still cover you even if it is COVID-19 related.

Please note, that every contract is different – it comes down to the wording/detail of the contract.

Questions and Answers Specifically About Personal Insurances & COVID-19 Coronavirus (We will continue to add to this section as the questions come through to us)

Q.Can I claim on my personal insurance policies if it relates to Coronavirus?

A. Yes, if you meet a condition of payment then you will be paid for that policy even if it is the coronavirus COVID-19 or related.

For example, let’s assume you had an income protection policy in place with a 14 day waiting period and a benefit period to the age of 65.

If the coronavirus led to you being unable to work for 2 months due to sickness/illness. The policy would pay you your sum insured for the 2 months less the initial 14 days.

As with all claims, customers must have fulfilled their disclosure obligations and have met the terms of their specific policy in order to be eligible for a benefit payment.

Based on the very nature of personal insurance policies they are typically outcome and impact related, not usually a specific illness related unless your policy has an exclusion that would have been stated to you upon application.

Q. Am I still covered even though COVID-19 Coronavirus is considered a pandemic?

A. Yes, you are still covered. As per the report on riskinfo.com.au insurers have confirmed that there are no exclusions in existing life insurance policies that would prevent the policy paying out for a claim related to Coronavirus as long as the policy holder has followed Government travel advice.

High quality personal insurance providers do not have a pandemic exclusion on their personal insurance policies. This is something you should review with your existing policy or what you are going to apply for. The financial services council policy manager said that “… all life insurance companies have pandemic risk management plans in place…” “with no expectation of it changing yet especially for existing insurance policies.”

Q. If I was to apply for a new policy will I be covered for anything related to coronavirus COVID-19?

A. In this article, multiple insurers such as ‘BT Life Insurance, AIA Australia, TAL, MLC Life, AMP Life, Clear View, MetLife, Integrity Life’ and more have indicated that NEW Customers will be treated no differently in terms of how the policy is impacted by the latest pandemic.

Standard medical tests and detailed questionnaires will apply as usual. If anything extra is excluded you will know before you reach the point of agreeing to take up the contract.

It was initially noted that NEW customers wouldn’t be affected, however with us being on the front line, we have seen some insurers place exclusions on clients policies, especially those involved in healthcare!

Estate Planning:

This section is what you need to know about distributing your estate.

What happens to my assets when I die?

Upon your death, your assets can be distributed via your Will, to named beneficiaries of life insurance policies, at the discretion of superannuation trustees, according to a trust deed or directly to the surviving owner of joint assets.

The following assets are not distributed through your Will

- Assets owned as joint tenants – have the ownership transferred to the surviving owner

- Assets owned as tenants in common – the percentage of the asset held by the person that died is distributed though their estate and not automatically transferred to the surviving partner

- Assets from a trust – are transferred through the trust deed rather than your Will and trust proceeds are distributed according to the trust deed

- Life insurance where you have nominated a beneficiary – proceeds, in the event of your death paid directly to the nominated person(s). Where your life insurance is held within your superannuation, your death benefit will be paid according to superannuation laws (see Superannuation below)

- Death benefits from your superannuation fund – will be paid in accordance with the Superannuation Industry Supervision Act (SIS), as decided by the fund trustee. You can formally nominate beneficiaries to direct the trustee to pay your benefit to the nominee or make binding nominations which forces the trustee to pay your death benefit to that nominated beneficiary as long as the nomination is valid. Nominees must be a spouse, a child under 18, a dependant or your estate. This nomination provides the fund trustees with certainty around your preferences for death payments. You must renew your binding nomination every three years or make a non – lapsing binding nomination on your superannuation fund, if the fund allows this. All nominations must be witnessed by at least two people who are non – beneficiaries.

What is a Will?

A Will is a legal document that sets out wishes including the distribution of your assets when you die. Making a Will is the only way you can ensure that your estate assets will be distributed according to your wishes.

Who prepares my Will?

- You can prepare your Will yourself or have a solicitor or other estate planning specialist prepare one for you. Where you decide to prepare your own Will, remember this is an important legal document and if strict legal requirements are not met, the Courts may deem it invalid, it may be contested as a result in your wishes may not be met.

- To minimise the potential for a successful challenge to your Will you should use the services of a solicitor experienced in this area. Your solicitor can also help to ensure that your testamentary capacity is established. This is especially important if you have young children, ex – spouses, blended families, a business or unusual instructions within your Will.

What should I include in my Will?

- Assets such as houses, cars, investments, etc. as long as they are not owned as “joint assets”.

- Rights and powers such as the right to appoint the trustee of a family trust.

- Specific bequests such as art, books, photographs and jewellery. It is important to provide descriptions that will make these items easy to identify.

- You can leave assets to whomever you choose including charities. You may choose to leave a percentage of assets, specific items or specific financial amounts.

- Where you have children or dependants under 18, you may identify how and when their inheritance is to be used. For children and other “at risk” beneficiaries, a testamentary trust may be appropriate.

When should I review / renew my Will?

As a general rule, you should review your Will every three years or whenever there is a major change to your personal and financial situation such as getting married (which will revoke an existing your Will unless it is made in anticipation of the marriage), separated or divorced (divorce does not revoke a Will but it cancels any provision in favour of the former spouse), entering into a de facto relationship, having a new child or grandchild, your executor or beneficiary dies or your financial circumstances change (eg major changes to your assets or unexpected windfalls).

Where should I keep my Will?

Keep your Will in a safe place where it can be found if you die. Some people prefer to keep their Will at their solicitor’s office. Make sure people around you know where to find your Will.

Where you do not want to tell anybody about your Will, or are concerned that it may not be found, you can also register your will with the national Will registry. In the event that you die, the person you nominate on the register will be advised of the Will’s location. There may be a small fee to use this service.

Who are the parties involved in a Will?

- A beneficiary – is someone who receives something from your estate.

- An Executor or Executrix – is responsible for administering your Will. You can nominate a person or persons you know, or opt for a professional executor service given the complications and time involved in executing an estate (anywhere from six months to several years).

- A Testator or Testatrix – is the person making the Will (you).

- A Trustee – is a person who administers a trust established under a Will. Again, you may choose a person(s) you know or use a professional trustee service.

What happens to my estate if I die without a Will?

Where you die without a valid Will, it means that you die intestate. Your assets will then be distributed according to a pre – determined formula with certain family members receiving a defined percentage of your assets despite what you may have wished. Depending on where you die, each state has its own rules that will apply. Where you die intestate with no surviving relatives closer than cousins, the State Government will receive all of your assets.

State law allows for the appointment of an administrator to administrate the deceased’s estate in the absence of a Will appointing an Executor chosen by the deceased. This person is given the duty of paying any debts the estate owed and distributing the assets in accordance with the rules of intestacy. They are given legal authority to act under a court order which is known as the grant of letters of administration.

What is a testamentary trust?

A testamentary trust us a trust that is created within your Will and doesn’t exist until you die and your Will is executed. They can be used to make regular payments to beneficiaries, rather than distributing assets as a lump sum. They are especially useful if:

- you have young children

- you have beneficiaries who are inexperienced or unskilled in managing large amounts of money, or are spendthrift

- you have beneficiaries who are bankrupt

- you have beneficiaries who are in an unstable relationship and you wish to avoid payment of your assets to a future ex – spouse.

Why should I consider using a trust?

There are several different types of trusts with each having a particular purpose;

- Children’s trusts – These are generally created in Wills and are managed for children until they reach the age of 18 or older as determined by the provisions of the Will. These trusts can be created to take effect if one or both parents die, and can help to provide a tax effective income to the children.

- Trusts for beneficiaries with a disability – These trusts are managed for the lifetime of someone who cannot manage their own affairs.

- Life estates – These trusts are set up to provide accommodation and / or an income stream for the lifetime of a close friend or relative. They are often used by people who have remarried and want to provide ultimate ownership of assets to their children rather than their spouse.

- Discretionary testamentary trusts – These are created by a Will and give the Trustee the discretion to split the income between a family group for a period of time. Ultimately, the assets are given outright to these people. Although changes in taxation laws may have an impact on these Trusts, they are currently tax effective because the Trustee has the ability to vary the income paid to each beneficiary depending on how much other income the beneficiary receives.

- Charitable trusts – You may wish to provide long term income benefit to a charity (such as for a scholarship or medical research), rather than giving an immediate gift. As these trusts can be very long term, it is in your and the charity’s interests to use the Public Trustee.

All these trusts need careful explanation and proper assessment of their benefits to you or your beneficiaries. It is often a matter of matching your wishes and your beneficiary’s needs with the right type of trust. Your solicitor or the Public Trustee is able to discuss your requirements and recommend the trust which is best suited to your needs.

What is a Power of Attorney?

A Power of Attorney is a document that appoints a person (called an “attorney”), to act on behalf of another person who grants the power (the “donor”) during the donor’s lifetime. The purpose of a Power of Attorney is to provide proof of the attorney’s powers. It allows the attorney to sign any document or do anything which the donor can do legally, subject to any conditions or limitations stated in the document.

Why do you need a Power of Attorney?

There are two types of Power of Attorney. A General Power of Attorney allows you to nominate a person to act on your behalf regarding your financial affairs allowing you to specify the period for which the Power of Attorney applies and in which areas your attorney can act on your behalf (e.g. pay bills, collect debts, vote at meetings, manage accounts, sell property etc).

An Enduring Power of Attorney (EPoA) allows you to nominate a person to look after your financial affairs both before and after you lose mental capacity. This document must be signed whilst you have mental capacity.

Where you do not have an EPoA in place, your spouse or closest family member will have to apply to the Guardianship Tribunal or its equivalent which is a process that can take several months. This can result in the person not having access to your money, investments or have the ability to sell property to fund medical expenses for you.

An EPoA immediately ceases to be effective when:

- You die.

- You revoke the document.

- Your attorney dies or loses decision making capacity.

- Your attorney becomes unqualified, eg bankrupt or paid health care provider.

- Sign a newer EPoA.

- You marry or divorce unless your new spouse is your existing attorney.

You can choose to revoke a PoA at any time.

What about health & living arrangements?

An Advanced Health Directive is a document which provides instructions about your choices for future health care and comes into effect only if you are unable to make your own decisions. Where you wish to complete an Advanced Health Directive, your doctor may be the most appropriate person to help you.

If you live in New South Wales, you can appoint an Enduring Guardian to make personal or lifestyle decisions on your behalf if you become incapacitated. An Enduring Guardian must be at least 18 years old and must not be providing you with professional medical treatment or providing you with care or accommodation or support services on a daily basis. Nor must they be a relation of any of the excluded people just mentioned.

You can give your enduring guardian as many or as few functions as you like. You may also give your enduring guardian directions on how to make decisions e.g. you may instruct that they are to consult with a close friend before making decisions. An enduring guardian cannot override your objections to medical treatment.