Written by David Thornton on August 19 2020, giving some insight about why selling up may not be a good recession strategy. Featured on MoneyMag

Recessions like the one we’re in now can send investors into panic, leading many to run for the door and sell up.

But history shows that giving up impressive return over the long term.

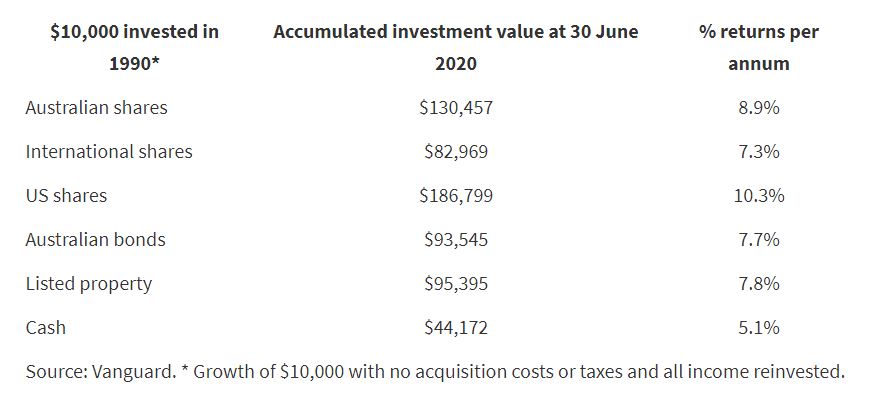

Vanguard’s 2020 Index Chart, which tracks different investment classes from 1990 to the current day, shows what you’d have today with an initial $10,000 investment in the relevant index.

For example, a $10,000 investment in the broad Australian share market in 1990 would have yielded 8.9% and grown to $130,457, while an investment in US shares would have returned 10.3% for a total of $186,799 (see table).

[The PeakWM team shared a detailed case study from the GFC about this same topic in our latest EBOOK, just ask if you want a copy or fill in your details in the section below and it will be sent immediately]

“While COVID-19 and its impacts could not have been predicted, bear markets are to be expected,” reassures Vanguard’s Robin Bowerman.

“What this chart [and table] aims to show is that taking a long-term perspective and investing in a range of broad market asset classes gives investors the best chance of investing success.

“There’s a wealth of research to show that time in the markets benefits most investors more than market timing, largely because market timing is incredibly challenging.

The best and worst days often happen close to one another and in many cases, timing the market for re-entry simply results in selling low and buying high.

Article continues below.

Selling during a market correction not only crystallises losses, but it also means missing out on the “bounce back”, where you see some of the strongest returns immediately following a correction.

What’s more, short term pain has a silver lining.

“Markets sometimes get over-exuberant and prices become excessive, but the opposite is also true,” notes Russell Investments.

“Short-term periods of crisis can push prices artificially low, creating excellent opportunities to buy.”

All this is not to say that you should tune out when markets are going through a rough patch. Indeed, rebalancing your portfolio can lead to even better results.

But it is to say that the daily rollercoaster moves of the stock market should be ignored, by and large.

“It can be hard to tune out daily market noise – particularly when it is being driven by a global pandemic – and procrastination is a natural result for those at the start of their investing journey,” says Bowerman.

“The antidote to procrastination is a disciplined plan to invest small, affordable amounts over the long term and let compounding and market returns go to work.”

Contact

Get In Touch

We are available to chat just give us a call on 0434 955 417 or 0411 472 213

If you prefer to send an email question/query through the best address is info@peakwm.com.au or simply fill out your name, email address and a short message including your phone number will get back to quickly.