By Jack Derwin, posted via businessinsider.com.au on May 18, 2020.

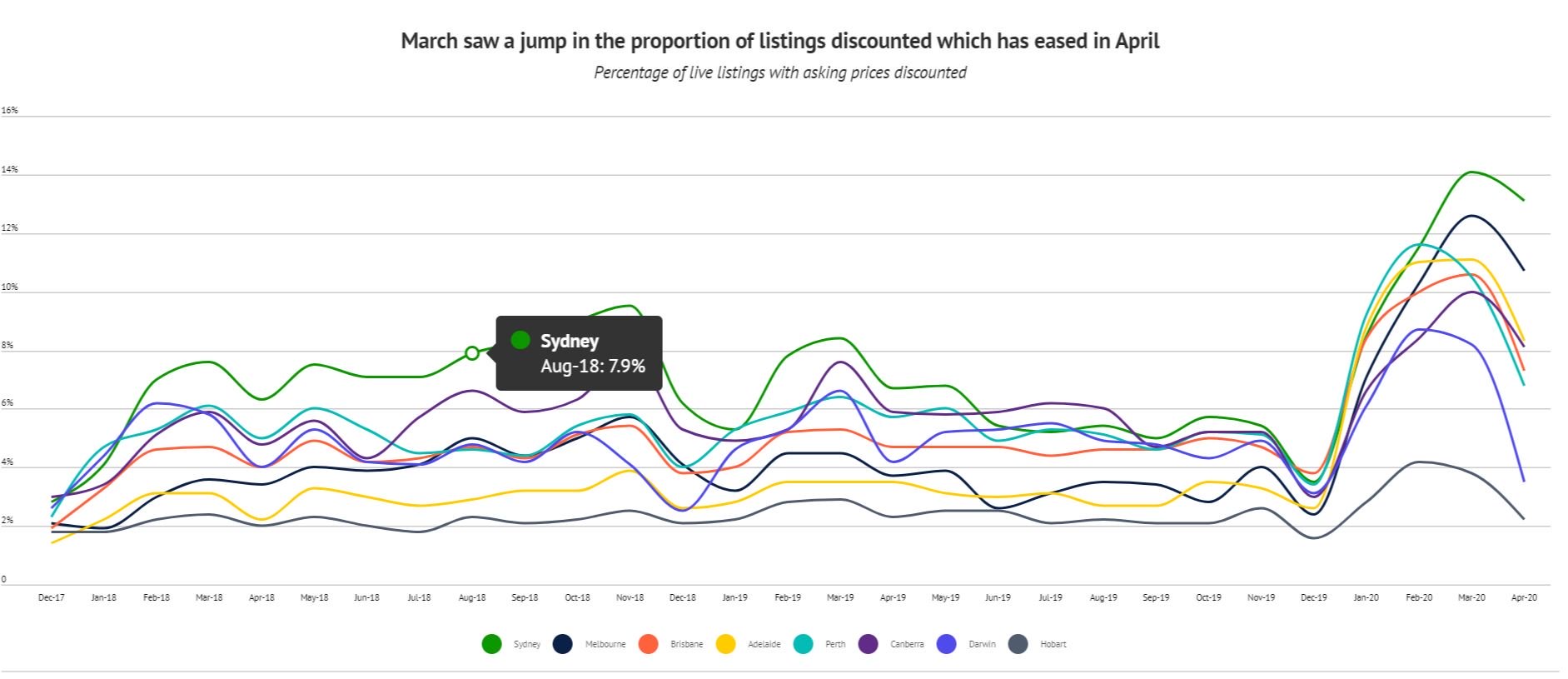

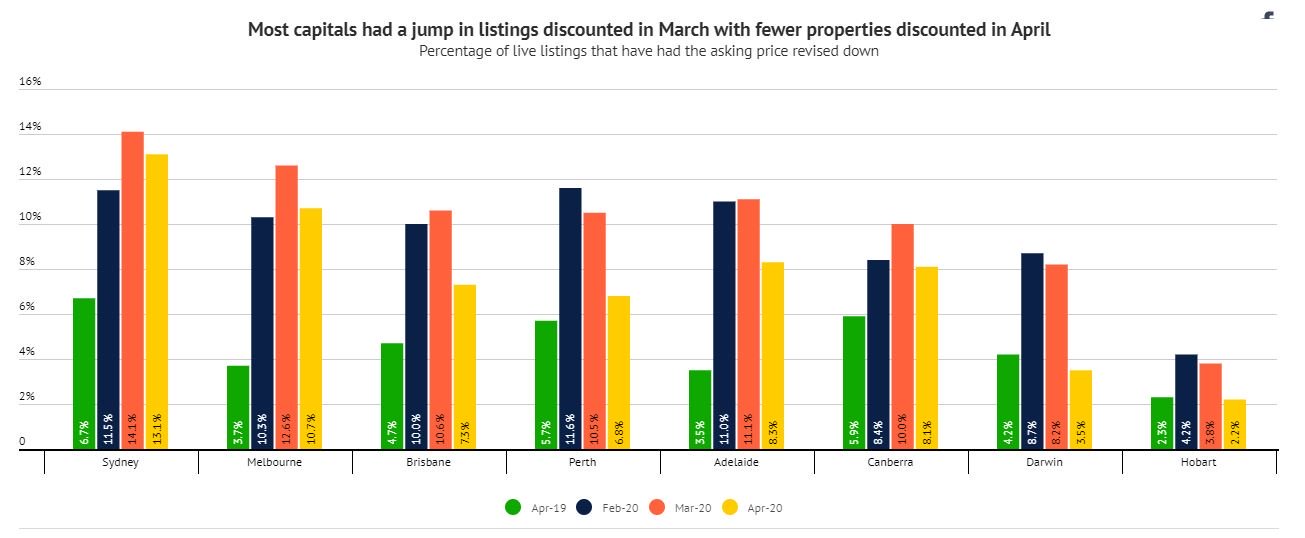

- Advertised prices throughout Australia’s capital cities are routinely being slashed, new analysis from Domain shows.

- Throughout February, March and April, the proportion of discounted properties soared, doubling and tripling on last year’s levels in Sydney and Melbourne respectively.

- The level of discounting typically indicates a market downturn and foreshadows price declines, analyst Nicola Powell noted.

In a softening property market, fortune favours the brave.

The latest analysis from Domain shows that while pickings might be slim, those Australians set on buying are being duly rewarded as those keen to sell slash their asking price to make it happen.

Sydney, the country’s most expensive market, has unsurprisingly seen one of the biggest rises, with nearly one in seven properties selling at a discount in March and April – or twice the rate as this time last year.

Melbourne’s meanwhile tripled, with around one in nine asking prices getting a haircut.

They were followed closely by Adelaide and Canberra where more than 8% were discounted, and Brisbane where 7.3% of property prices were reduced.

The caveat here being that the number of properties on the market has also declined dramatically in recent months.

“Most capital cities saw a peak in March, but Perth, Darwin and Hobart hit a peak earlier in February, with the proportion of listings discounted subsequently declining over March and April,” Powell said.

“This coincides with the lower coronavirus cases and quicker flattening of the curve compared to other jurisdictions, indicating a quick reaction from vendors and improved sentiment once containment was achieved locally.”

However, Powell cautiously posits that the worst may be behind the capital cities as pandemic fears ease.

“Price expectations clearly changed rapidly during this time, with vendors adjusting prices to seek a timely sale in fear of what may be ahead,” she said.

Supported somewhat by declining stock on sale, the size of the discounts haven’t increased on last year’s levels – with the average remaining around 4% in Sydney and Melbourne – it does point to declining prices ahead.

“These early signs suggest a broader market slowdown with more properties discounted by more marginal amounts rather than hefty discounts on fewer homes,” Powell said.

“The proportion of properties discounted tends to align with price movements, providing a leading indicator for price growth.

During an upswing, fewer properties are discounted and the opposite occurs during downturns.”

Given the growing number of seven-figure price tags over the years in some capitals, however, one might argue there may be a sale on, but bargains remain few and far between.

By Jack Derwin, posted via businessinsider.com.au on May 18, 2020.

Contact

Get In Touch

We are available to chat just give us a call on 0434 955 417 or 0411 472 213

If you prefer to send an email question/query through the best address is info@peakwm.com.au or simply fill out your name, email address and a short message including your phone number will get back to quickly.