By Jack Derwin posted in the Business Insider Page April 14, 2020

As the COVID-19 threatens to put another 700,000 Australians out of work, there’s plenty to make people nervous.

This is also the case if you, like many, have borrowed heavily to buy a home in which to live or rent out as an investment.

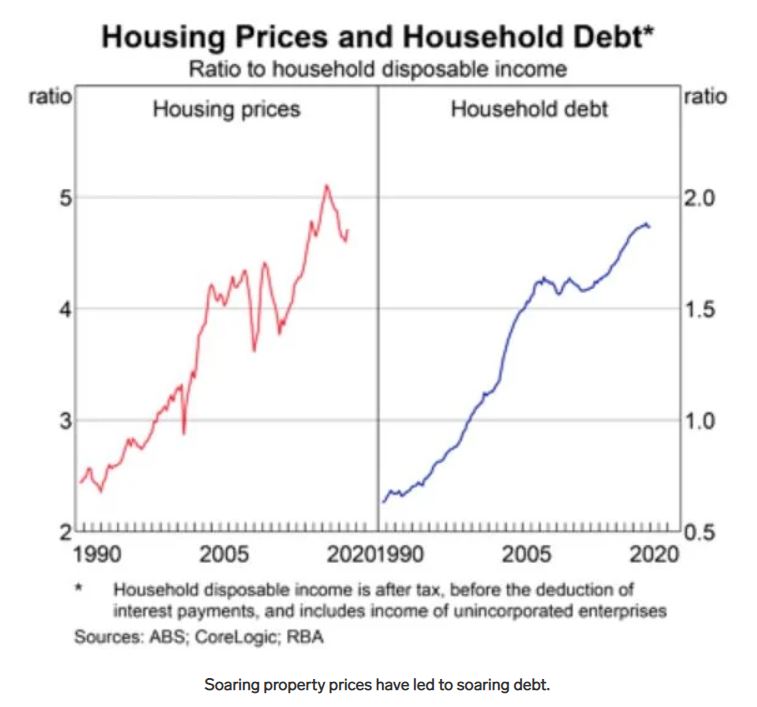

As prices have soared, especially in often unaffordable capital cities like Sydney and Melbourne, many have been forced to take on high six-figure, or even seven-figure, loans to get onto the property ladder.

It’s a phenomenon that has helped Australia reach the unenviable position of holding some of the most household debt in the world.

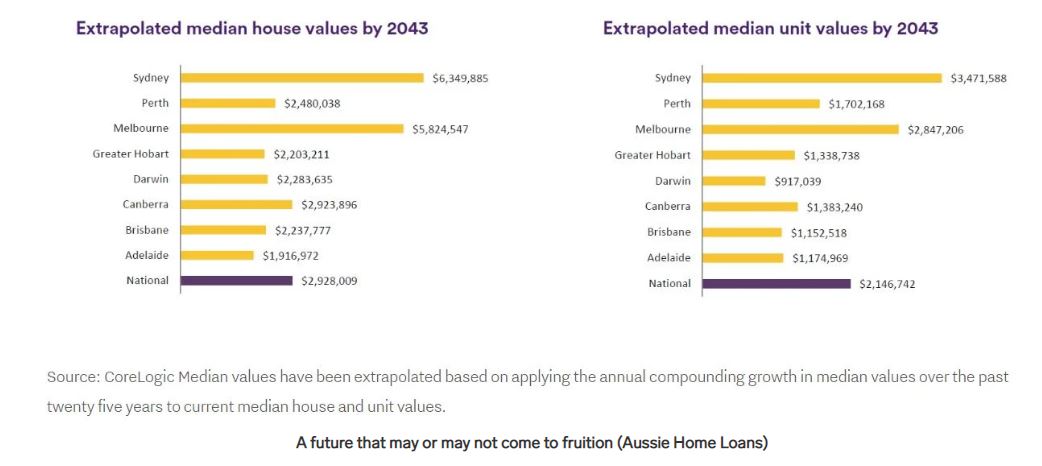

It made sense on paper.

As values rise, what may cost $500,000 today could sell for over $700,000 in the years to come.

As with all investments however, past performance is no indicator of future performance – despite what this overzealous extrapolation from Aussie Home Loans might suggest.

But as housing pundits will tell you, the size of the debt doesn’t matter as much as the serviceability of the loan – in layman’s terms, the ability of households to make their repayments.

As long as those can consistently be paid, debt levels aren’t necessarily relevant.

However, with unemployment scheduled to double by June – without even mentioning rising underemployment – the jobs of homeowners, investors and tenants are suddenly looking a little less secure.

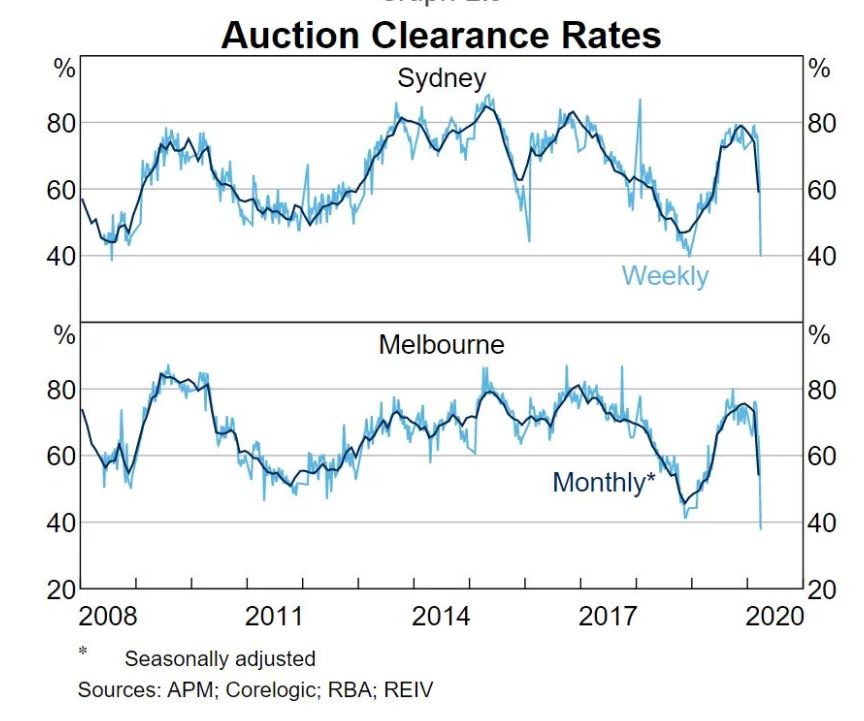

Take the Financial Stability Review published by the Reserve Bank of Australia (RBA) on Thursday.

While acknowledging the significance of various government measures, including its $130 billion JobKeeper package, the RBA recognised some households “are not as well placed to withstand the downturn”.

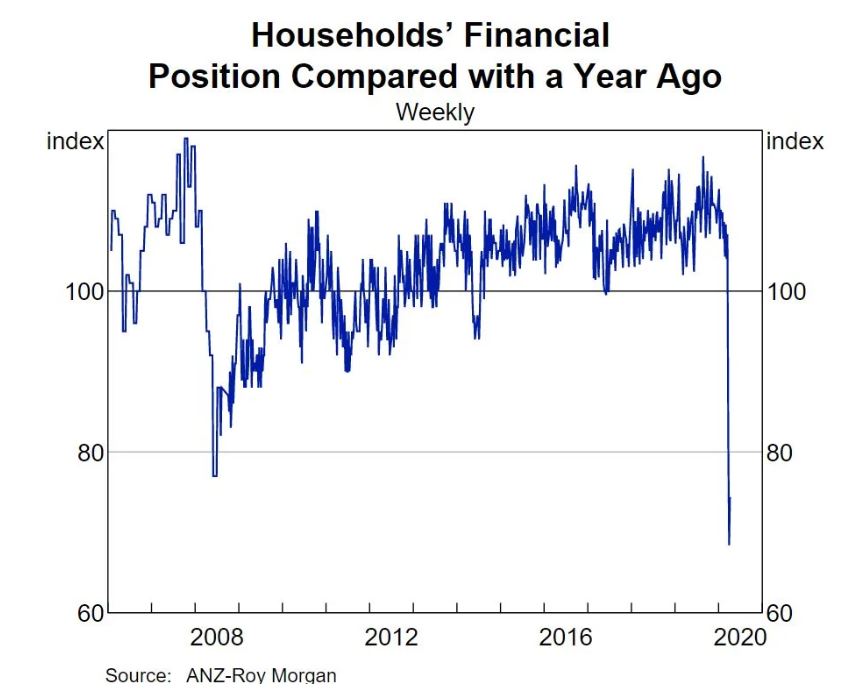

“To date, a large number of workers have been stood down, and many jobs have already been lost or are expected to be lost in the period ahead.

The associated uncertainty is clearly weighing on household perceptions of their own financial situation,” the RBA said, noting consumer confidence is at its worst level in more than a decade.

There are some good reasons why Australians are feeling the pinch.

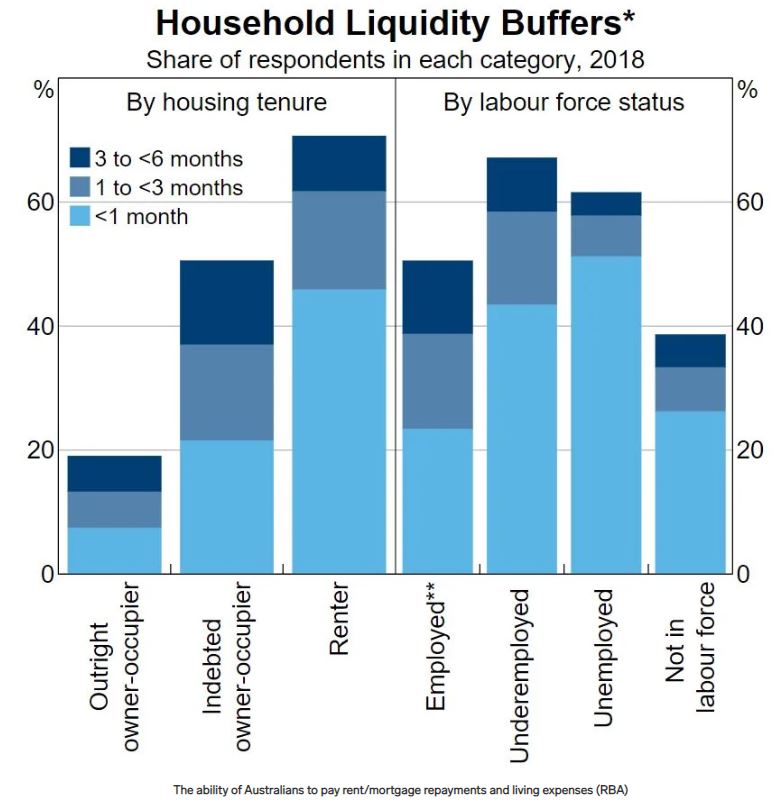

According to a 2018 survey, more than one in two mortgagees and more than three-quarters of renters would be unable to pay six months worth of living expenses and housing costs.

In fact, around half of all renters and a fifth of all mortgagees couldn’t even pay one month’s worth.

In other words, many have little breathing space.

“Surveys indicate that about one in five households only has enough liquid assets to get from one pay period to the next,” the RBA noted.

“These liquidity constrained households are typically young, twice as likely to be renting and twice as vulnerable to unemployment compared with other households.”

“Amongst households with mortgage debt, just under one-third of mortgages have less than one month of prepayments, and about half of these appear particularly vulnerable to a sharp decline in income.”

Some will have their jobs secured by the wage subsidy.

Others won’t, including the nearly one million casual workers who have been with a business less than 12 months.

“The most vulnerable include those working in jobs more exposed to unemployment risk, such as casual workers, and those in industries most affected by the COVID-19 containment measures, such as accommodation and food services,” the RBA said.

Some will be covered by JobSeeker Allowance payments, administered via Centrelink, and again, others won’t, including non-residents, those under the age of 22, and those whose partners make over $80,000 a year.

Contact

Get In Touch

We are available to chat just give us a call on 0434 955 417 or 0411 472 213

If you prefer to send an email question/query through the best address is info@peakwm.com.au or simply fill out your name, email address and a short message including your phone number will get back to quickly.

50 Most Influential Advisers Australia 2024 Finalists – FS Power 50

Andrew Debono and myself have been shortlisted from 15,000 advisers in the country to the final 114 shortlisted nominees. We do our absolute best for our clients, peers and community. It is great to have the industry recognition. Now that judges have chosen finalists...

FS Power50 – 50 Most Influential Advisers in Australia 2023 – Andrew Debono, Peak Wealth Management

Celebrating Andrew Debono: Twice Recognised Among Australia's 50 Most Influential Financial Advisers. FS Power50 - 50 Most Influential Advisers in Australia 2023, following being named in 2022. We are absolutely delighted to share some thrilling news about our...