Last night’s Federal Budget was the first delivered by the new Labor government that was elected in May 2022.

Given the present state of the economy post-COVID, a worsening economic position due to inflation and increased global instability, rising interest rates and cost of living pressures, the Budget was conservative by nature. There were no big surprises and it didn’t include any outrageous changes.

While the Budget did not contain any single “hero” initiatives, it was wide ranging and introduced a variety of measures. Apart from addressing cost of living pressures, it could also be described as a “green” budget with environmental initiatives being featured.

We have added in the sections that we feel are most relevant to our clients.

Please note, the items put in the budget are subject to the successful passage of relevant legislation.

State of the Economy:

In the face of a deteriorating global economy and continuing uncertainty around the world, Australia is facing challenges despite some positive outcomes.

By way of a quick snapshot, the economic highlights include:

- $28.5% in budget improvements, with the underlying cash deficit in 2022-23 expected to be $36.9bn, down significantly from that announced in the March 2022 Budget.

- The economy is expected to grow by 3¼% in 2022-23 before slowing to 1½% in 2023-24.

- Unemployment is at a historic low level and is expected to remain low through until June 2024.

- Rising interest rates and inflation are negatively impacting many families with wages growth not keeping pace with increased costs of living. Inflation is expected to hit 7¾% by the end of 2022 before starting to ease over the following two years.

Superannuation/Downsizer Contibutions:

Expanding the eligibility for downsizer contributions – The Government will allow more people to make downsizer contributions to their superannuation, by reducing the minimum eligibility age from 60 to 55 years of age. The measure will have effect from the start of the first quarter after Royal Assent of the enabling legislation.

The downsizer contribution allows people to make a one-off post-tax contribution to their superannuation of up to $300,000 per person from the proceeds of selling their home. Both members of a couple can contribute and contributions do not count towards non-concessional contribution caps.

Child Care:

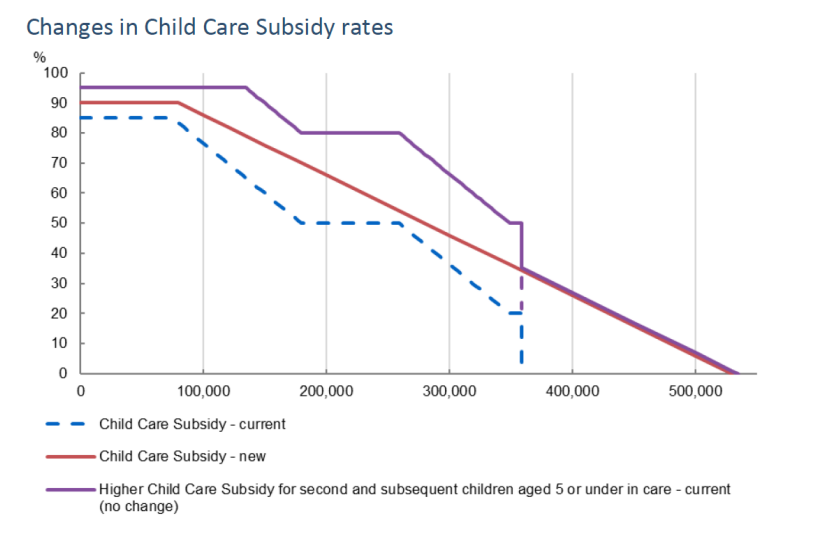

Child Care Child Care Subsidy – extending eligibility From 1 July 2023, Child Care Subsidy rates will increase from 85% to 90% for families earning less than $80,000. Subsidy rates will then taper down 1% for each additional $5,000 in family income, until the maximum income threshold of $530,000 is reached. Families will continue to receive the existing higher subsidy rates of up to 95% for their second and subsequent children in care, who are under age 5. The below graphic compares the proposed (new) subsidy rate with the current subsidy. The x axis represents family income. You can find the definition of income

Paid Parental Leave:

The government is proposing numerous changes to the Paid Parental Leave scheme.

Extending the number of weeks – Currently, families can access 18 weeks of Paid Parental Leave under the scheme. This comprises of 16 weeks for the birth parent (or an adoptive parent) and 2 weeks for their partner. It is proposed that the number of weeks will increase to 20 weeks in 2023-24, 22 weeks in 2024-25, 24 weeks in 2025-26 and 26 weeks from 2026-27.

Introducing greater flexibility – Here are some of the 1 July 2023 proposals aimed at making the scheme more flexible:

- Parents will be able to take government-paid leave up to the maximum number of weeks and can use it flexibly between them.

- Single parents will be able to access the full entitlement each year.1

- Parents will be able to take government-paid leave in blocks as small as a day at a time, with periods of work in between, so they can use their weeks in a way that works best for them.

- There will be assigned ‘use it or lose it’ weeks for each parent, designed to encourage each of them to take that portion of the parental leave.

- Either parent will be able to claim Paid Parental Leave first and both parents can receive the payment at the same time as any employer-funded parental leave.

Broadening eligibility – Eligibility will be expanded through the introduction of a $350,000 family income test, which families can be assessed under if they don’t meet the individual income test.

Green Initiative:

FBT Electric Cars – From 1 July 2022, the measure will exempt battery, hydrogen fuel cell and plug-in hybrid electric cars from fringe benefits tax and import tariffs if they have a first retail price below the luxury car tax threshold for fuel-efficient cars. The car must not have been held or used before 1 July 2022. Employers will need to include exempt electric car fringe benefits in an employee’s reportable fringe benefits amount.

Cryptocurrency:

Digital currencies not a foreign currency – the Budget Papers confirm that the Government is to introduce legislation to clarify that digital currencies (such as Bitcoin) continue to be excluded from the Australian income tax treatment of foreign currency

As always, please let us know if you would like to chat about this, or anything else in greater detail. We are here to help.

If you have anyone in your network that you think would benefit from having a chat, please make the introduction.

Chat soon,

PeakWM