The well written article by Julia Newbould on February 26, 2020 in MoneyMag.com.au discusses the following 7 key headings:

- What is salary sacrificing?

- Can anyone salary sacrifice into super?

- Who is salary sacrificing best suited to?

- What is the difference between concessional and non-concessional contributions?

- Is there anything to be aware of when salary sacrificing?

- Can I salary sacrifice whenever I choose?

- What should I do before salary sacrificing into super?

PeakWM – Peak Wealth Management Sydney based financial advisers summary of the article with some extra information:

- Salary sacrificing (for super) refers to contributing your before-tax employment income into your superannuation account.

- The assumed benefit with this strategy is paying less tax while boosting your retirement savings.

- Salary sacrificing your income into superannuation can make a lot of sense purely from a numbers perspective, especially at higher income levels.

- The superannuation tax environment is capped at 15%

- In Australia, your personal tax environment is capped at 45% (plus medicare levy)

- Your personal financial situation should dictate whether you further utilise the superannuation environment over and above your employer contributions.

- According to MoneySmart.gov.au – generally, making extra concessional contributions is tax effective if you earn more than $37,000 per year.

- There’s a limit to how much extra you can contribute. The combined total of your employer and salary sacrificed contributions must not be more than $25,000 per financial year.

- The opportunity cost of the lower tax environment is not having access to the funds until you reach preservation age which can change (legislation risk).

- A very simple example of a time where salary sacrificing your employment income may not be appropriate is if you have no surplus cash flow in your budget. Although there may be a tax benefit to salary sacrificing your income, the opportunity would be considered foregone to continue to meet your living expenses.

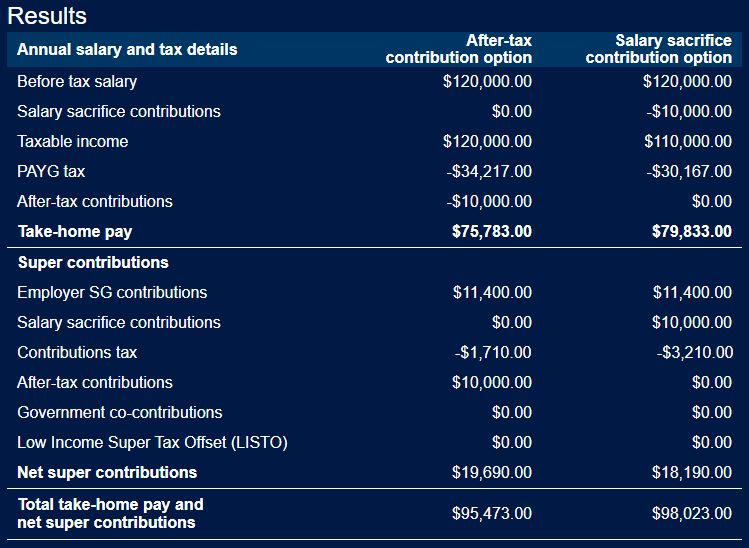

Simplified Example of what Salary Sacrifice tax savings look like practically. (This is not advice and doesn’t consider all levies or clients’ situations – it is designed to help understand the tax savings concept.)

We want to give you an easy understanding of what a salary sacrifice tax saving looks like. Please note, a more detailed screen snippet taken from a salary sacrifice calculator has been included below which shows the impact of contributing $10,000 of income to superannuation before tax vs after-tax contribution, including an example of take home pay.

$10,000 salary sacrifice for an Individual on $120,000 income

Tax rate on income at $120,000 is 37c for each dollar from $90,001 to $180,000.

Tax rate on superannuation concessional contribution is 15c per dollar.

$10,000 x 0.37 = $3,700 tax savings

$10,000 x 0.15 = $1,500 tax paid

$3,700 – $1,500 = $2,200 tax savings for the $10,000 salary sacrifice.

Seven things you need to know about salary sacrificing into super (full article as seen in MoneyMag)

Written by Julia Newbould, shared from MoneyMag February 26, 2020.

Your super can receive a significant boost when you pay less tax before making additional contributions. Salary sacrificing boosts your super in a way that costs you less than the benefit – and it’s an option open to most of us when we want to build our super quickly and effectively.

1. What is salary sacrificing?

Salary sacrificing for super involves contributing pre-tax dollars from your salary into your superannuation account. Your employer is legally obliged to contribute 9.5% of your salary into your super and you are able to contribute extra – up to $25,000 in concessional contributions (pre-tax) and $100,000 in non-concessional contributions (after tax).

This means if you’re earning less than $263,000, you have capacity to contribute additional funds to reach the $25,000 concessional cap; however, you should make sure you know exactly how much more you can put in before reaching the threshold as you might otherwise be heavily penalised.

You may choose to increase the percentage of your salary sacrificed into super, or you may choose to sacrifice a lump sum payment from your pay as a one-off or occasional sacrifice.

Some employers offer an opt-out contribution scheme where each employee is putting an extra, say 3%, into super unless they elect not to. However, it is more typical for people to opt into extra contributions.

2. Can anyone salary sacrifice into super?

Anyone can salary sacrifice into super – it is an arrangement you must make with your employer. Putting some of your pre-tax income into super has benefits for you as your super fund will tax these contributions at 15% — the same as your employer’s contributions – and for most people this will be lower than their marginal tax rate.

If you earn $100,000pa and decide to salary sacrifice $10,000 into your super fund, while your super fund will be credited with the full $10,000, your take home pay will not be reduced by $10,000 but instead by the after tax amount of $6300.

3. Who is salary sacrificing best suited to?

Salary sacrificing is best suited to anyone whose marginal tax rate is over 15%. It is also suited to people wanting to build their super balance quickly – for example, people who have been out of the workforce for extended periods, or people close to retirement.

There is also a way of salary sacrificing while drawing down on your super balance which is a transition to retirement strategy.

4. What is the difference between concessional and non-concessional super contributions?

Concessional super contributions are contributions to your super for which you have benefited from concessional tax rates. Non-concessional contributions are when you have put money on which you have already been taxed into super.

Both receive concessional tax treatment on earnings inside super.

5. Is there anything to beware of when salary sacrificing?

It’s important to ensure you stay within the contribution limits when salary sacrificing into super – and that is making sure your total concessional super contribution is not more than $25,000.

If you salary sacrifice more than the $25,000 concessional super cap you may have to pay your marginal tax rate on the excess amount and an additional excess concessional contributions charge.

6. Can I salary sacrifice whenever I choose?

You can choose to salary sacrifice at any time provided you have agreement with your employer and that you are not exceeding the contribution limit. Many people chose to wait until close to the end of the financial year so they know how much they can afford to sacrifice into super and also, how close they are to reaching the contribution cap.

7. What should I do before salary sacrificing into super?

Know how much you are currently contributing to super through your employer’s 9.5% super guarantee. Then you will know how much more you are eligible to contribute as concessional.

Understand your budget and how much of your salary you can afford to sacrifice.

Consider using bonus payments or increases in salary as a painless way to salary sacrifice – this way you manage to live on your previous income and boost your super.

Contact

Get In Touch

We are available to chat just give us a call on 0434 955 417 or 0411 472 213

If you prefer to send an email question/query through the best address is info@peakwm.com.au or simply fill out your name, email address and a short message including your phone number will get back to quickly.